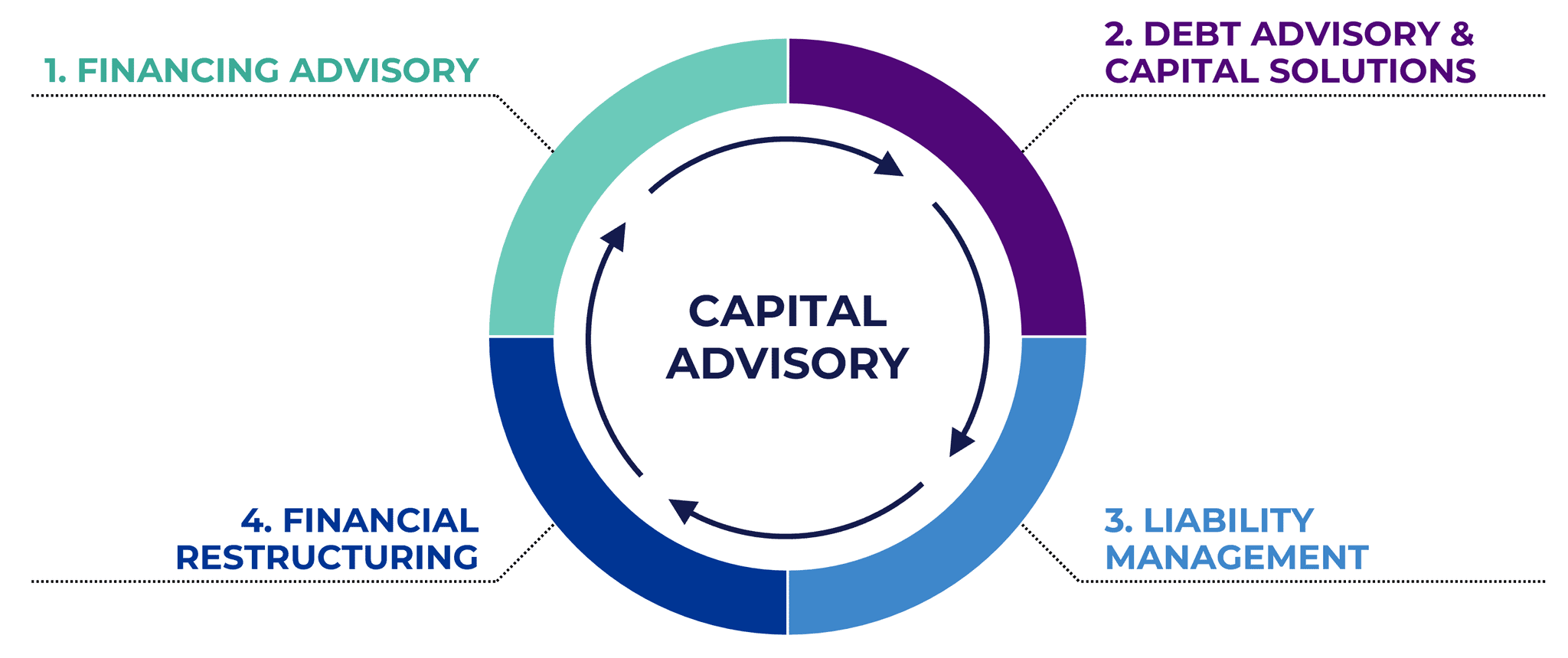

Capital Advisory

COMPREHENSIVE FINANCING SERVICES TO SUPPORT OUR CLIENTS’ UNIQUE NEEDS

The Capital Advisory team partners with the firm’s sector experts to provide clients with value-maximizing solutions to navigate all stages of an organization’s life cycle in varying capital availability environments. Solomon Partners provides independent guidance across a comprehensive range of services, including debt advisory, special situations financing and liability management, and financial restructuring.

The evolution of the public and private markets offers new opportunities and increased flexibility for our clients. By advising across these market dynamics, we work closely with clients to understand their strategic objectives and develop solutions and implementation plans tailored to achieve their goals while minimizing execution risk and reducing the blended cost of capital.

CAPITAL ADVISORY SERVICES SUPPORT BROADER STRATEGIC INITIATIVES

Description

Financing Advisory

Debt Advisory & Capital Solutions

Liability Management

Financial Restructuring

Financing Advisory

Arrange private capital solutions and provide process management services related to all forms of financings

Provide independent advice related to syndicated market financing options compared to potential private financing advisory alternatives

Representative Services¹

Asset-based loans

Corporate revolvers

Structured finance

Cash-flow loans (e.g., 1L, 2L, unitranche)

Mezzanine financing

Carve-out collateral financings

Common equity

Debt Advisory & Capital Solutions

Lead negotiations with issuers or stakeholders (e.g., creditors) to modify contractual obligations to facilitate our clients’ ability to implement strategic objectives

Structure and negotiate new debt, equity or hybrid instruments

Representative Services¹

Evaluation of capitalization options

Debt document assessment

Hybrid debt

Preferred equity

Equity-linked financings

Amendments and consent solicitation

Liability Management

Structure, negotiate, and execute complex financing transactions for clients or stakeholders where company access to the broadly syndicated or “regular-way” private capital market is not optimal

Advise on financing options, including liability management transactions which may result in comprehensive balance sheet recapitalizations that enhance liquidity and increase value

Representative Services¹

Structurally senior financing

Amend and extend transactions

Discounted debt repurchases

Non-traditional existing stakeholder financings (e.g., up-tier exchanges, drop-down transactions, credit support-enhancing financings)

Non-core asset sales

Financial Restructuring

Work with companies, creditors, boards, or other constituencies on complex financial restructurings and distressed M&A transactions that may be implemented out of court or via in-court or court-supervised proceedings

Representative Services¹

Develop comprehensive review of strategic alternatives

Lead stakeholder negotiations

Amendments, waivers, and forbearance agreements

Debt-for-debt and debt-for-equity exchange offers

(in- or out-of-court)

Non-core asset sales

Sell-side and buy-side distressed M&A advisory

Expert testimony

Representative Services¹

Asset-based loans

Corporate revolvers

Structured finance

Cash-flow loans (e.g., 1L, 2L, unitranche)

Mezzanine financing

Carve-out collateral financings

Common equity

Evaluation of capitalization options

Debt document assessment

Hybrid debt

Preferred equity

Equity-linked financings

Amendments and consent solicitation

Structurally senior financing

Amend and extend transactions

Discounted debt repurchases

Non-traditional existing stakeholder financings (e.g., up-tier exchanges, drop-down transactions, credit support-enhancing financings)

Non-core asset sales

Develop comprehensive review of strategic alternatives

Lead stakeholder negotiations

Amendments, waivers, and forbearance agreements

Debt-for-debt and debt-for-equity exchange offers

(in- or out-of-court)

Non-core asset sales

Sell-side and buy-side distressed M&A advisory

Expert testimony

¹Not a comprehensive list of services, and services are not limited to sample set provided.

transactions

NEWS & INSIGHTS

GLOBAL EXPERTISE FROM OUR NATIXIS PARTNERSHIP

Today, Solomon Partners is an independently-run affiliate of Natixis, part of Groupe BPCE, a top ten European and top 20 global bank. Our partnership provides our clients with global coverage across the Americas, EMEA and APAC.