Mergers & Acquisitions 2025 M&A Outlook: Technology, Energy and Logistics

by Demitri Diakantonis

The M&A landscape continues to evolve, shaped by shifting economic conditions, a new political regime and dynamic corporate strategies. As we move into the new year, Mergers & Acquisitions presents a week-long special series: The 2025 M&A Outlook. In it, we gather insights from dealmakers across all corners of the M&A world to explore key trends, emerging opportunities and potential challenges that will define the dealmaking environment in the coming year.

Key sectors like technology, energy and logistics are bracing for significant shifts. In technology, a bifurcation in software investment presents opportunities to target premium assets while capitalizing on undervalued ones. The energy sector is poised for consolidation, with clean energy at the forefront. And the logistics sector is attracting attention, as businesses look to outsource specialized functions for improved efficiency and reduced risk. These sectors offer fertile ground for M&A as dealmakers navigate a rapidly changing landscape.

What’s your view for the year ahead in a sector you are most familiar with?

Energy

Andrea Guerzoni, Global Vice Chair of Strategy and Transactions, EY: The energy sector will continue to drive deals as companies reset their portfolios and smaller firms, lacking access to capital, become targets. The life sciences sector will also see strong deal activity as larger players seek to replenish their portfolios in response to drugs coming off patent and new treatment pressures. Additionally, the industrials sector is expected to accelerate as companies build portfolios aligned with future demand and geopolitical realities.

Jeff Jacobs, Head of M&A and COO of Investment Banking, Solomon Partners: As the clean energy industry continues to scale to meet record renewable energy generation demand, corporate consolidation is anticipated. We expect new sources of capital to enter the market, as attractive risk-adjusted returns persist, and thematic investment remains strong. Investors will focus on distributed energy, as the importance of reliability becomes a critical factor to enduring increased occurrences of extreme weather. Bipartisan collaboration, along with partnerships across public and private entities, are critical to success, particularly to meet record data center demand, where massive amounts of new generation are required for the U.S. to maintain its lead in artificial intelligence.

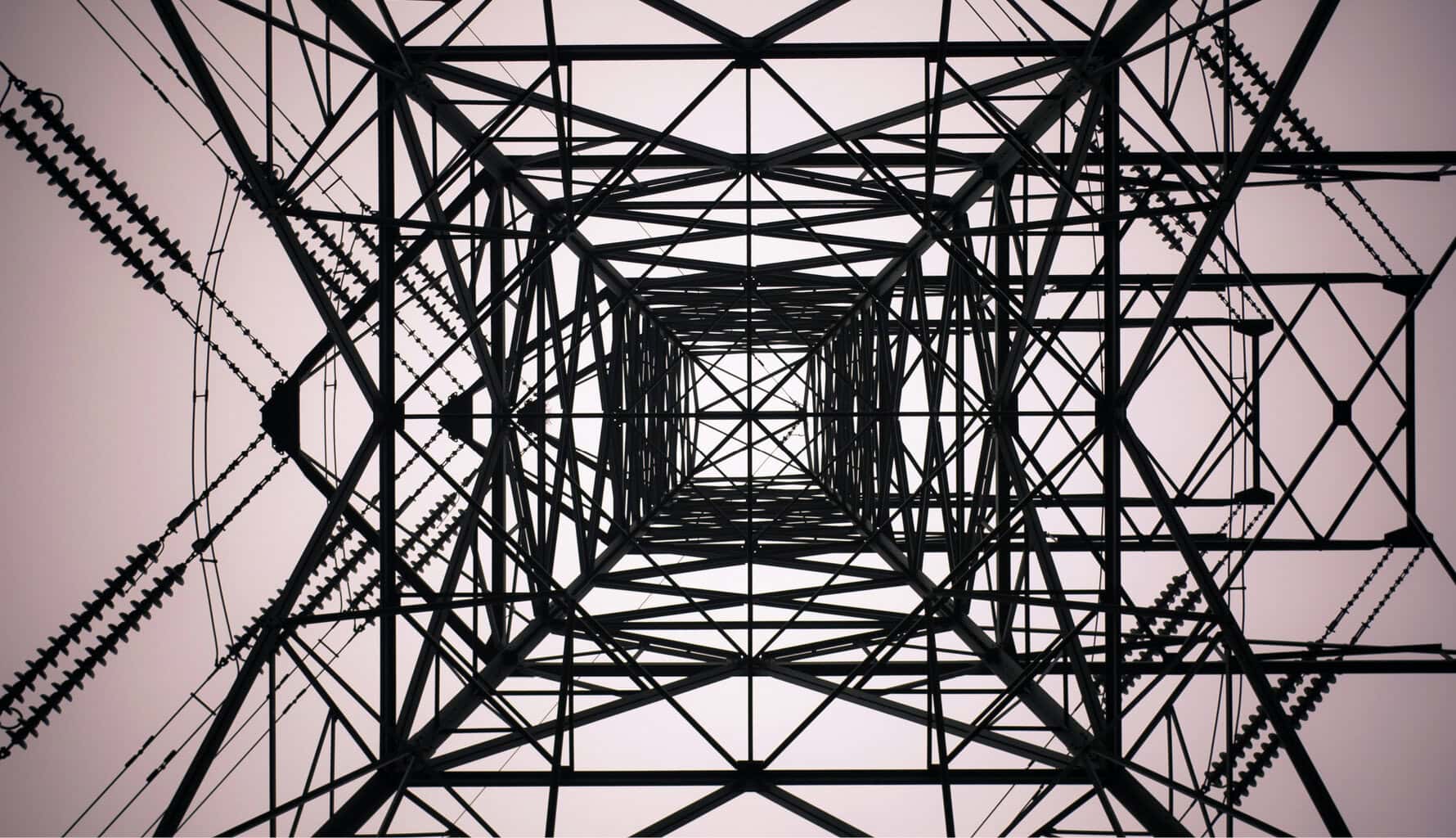

Michael Marek, Partner — Mergers & Acquisitions and Private Equity, Vinson & Elkins: Pay attention to the second and third order impacts of AI on the energy value chain. Projections for increased power demand will drive M&A not just for generation and transmission, but for the manufacturing companies that build the structures, substations, and instrumentation, as well as the services businesses use to maintain this infrastructure, and the engineering and consulting groups whose expertise all the above rely upon.

Technology

Byron Lichtenstein, Managing Director, Insight Partners: Software investment multiples have come down on average. However, there is a bifurcation in the market with premium software assets commanding multiples that rival 2020 and 2021, while the rest of the market is far below recent historical averages. We believe there is an opportunity to take advantage of this bifurcation by 1) picking our spots on which select premium assets we pay up for, while 2) thoughtfully purchasing assets that would benefit from our value-add support team to be premium assets down the road.

Matthew Simpson, Co-Chair, Private Equity, Mintz: Digital infrastructure will be a hot area with hyperscalers looking to build up their portfolios of large data centers while simultaneously shedding smaller assets that cannot meet the increased demand loads of hyperscalers. U.S. funds are continuing to increase their presence in the North American digital infrastructure market, which will put additional pressure on CFIUS and other related regulatory bodies to address perceived threats from foreign investment in this space.

Logistics

Frank Mountcastle, Head of M&A, Harris Williams: In 2025, we believe freight volumes across most, if not all, modes will slowly improve alongside macroeconomic conditions. We also think 3PLs (third-party logistics) will continue to improve productivity and margins through technology, process innovation, and automation, all of which can help offset rising labor costs. It’s also important to note that in an era of ongoing disruptions, 3PLs now play an increasingly strategic role for their customers. Companies across industries are elevating supply chain decisions to the C-suite and are relying on 3PLs to help them optimize moves, spending, reliability, sustainability, performance, and on-time delivery. Shippers are showing much greater demand for data analytics, giving 3PLs an opportunity to make sense of their data and turn insights into actionable strategies. This increasingly important role for 3PLs in the global economy reinforces our confidence in the long-term growth of the space and makes the sector an attractive investment opportunity.