The 2024 Paris Olympics and the Future of Sports Advertising

Streaming Drives Olympic Viewership Growth

The Olympics advertising landscape evolved, expanded, and innovated through the 2024 Paris Games, which set new benchmarks for viewership, engagement, and access. Attracting an average of 30.6 million daily viewers across streaming, digital, and traditional television platforms, viewership was up 82% from the 2021 Tokyo Games.(1)

NBCUniversal, which paid $7.65 billion to renew its broadcasting rights deal through 2032,(2) maximized audience reach by providing unprecedented streaming access on Peacock, including live coverage, exclusive content, and interactive features.

Viewers streamed a record-breaking 23.5 billion minutes of Olympic content,(1) and Peacock realized eight of its 10 highest streaming days ever during the event.(1) Perhaps most remarkably, streaming viewership was 40% higher than the combined total from all previous Summer and Winter Olympic Games.(3) As a result, Paris was the first comprehensive multiplatform Olympic Games.

NBCUniversal’s Strategic Advertising Expansion

With the addition of Peacock’s streaming options, NBCUniversal doubled its ad inventory and, for the first time, made both the Olympic and Paralympic Games available to advertisers programmatically. Programmatic advertising refers to the use of automated software and consumer data to serve ads that target specific audiences in real time.

Through a partnership with the programmatic platform The Trade Desk, NBCUniversal introduced a bid-accessible private marketplace. Consequently, 70% of advertisers were first-time Olympic sponsors,(4) that contributed more than $500 million in revenue(4) before the midpoint of the Games.

In fact, the total number of advertisers was more than double that of the 2021 Tokyo and 2016 Rio Games combined.(1) NBCUniversal’s multiplatform strategy also allowed for experimentation with new advertising formats, including a commercial-free hour of programming that swapped traditional ad breaks for rotating sponsor logos. These integrated programmatic opportunities both avoided interrupting content and reduced advertising production costs for media buyers.

The Digital Shift in Sports Advertising

Looking forward, the success of the 2024 Olympic Games represents a structural shift in the sports advertising market. Gaining access to high-profile live sports advertising inventory historically required direct deals with publishers, which involved high minimum spends, lengthy lead times, and complex production requirements.

As traditional broadcast models give way to more digital, on-demand options, the Olympics demonstrated how programmatic ad buying can open doors to a broader range of advertisers, and that the future of sports media lies in multiplatform access, programmatic buying, and innovative ad formats.

Streaming industry trends support this thesis. Most major streaming services have secured licensing deals with various collegiate and professional leagues.

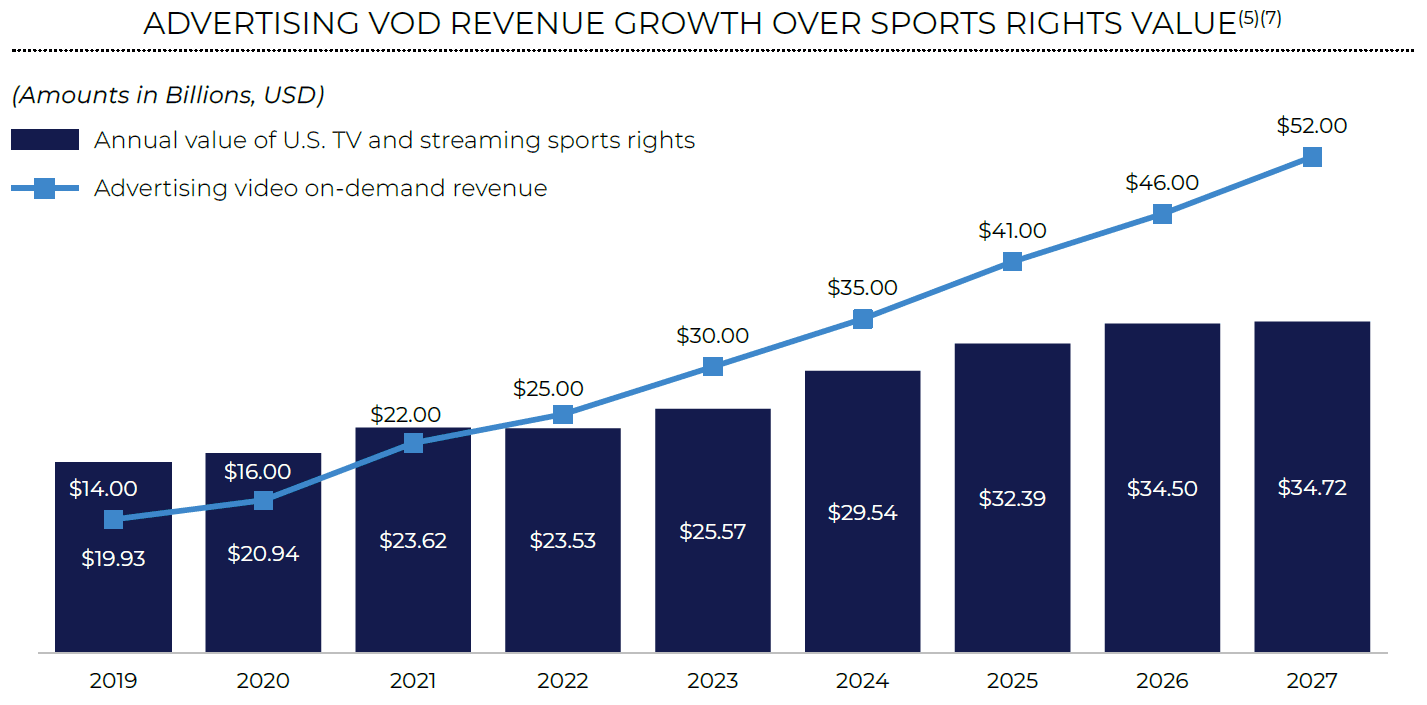

In the U.S., sports media rights payments totaled $29.54 billion in 2024, more than doubling since 2015,(6) despite the pay TV penetration rate in the U.S. dropping from 83% to 64% over the same period.(7) Simultaneously, streamers are introducing lower-cost, ad-supported subscription tiers, and advertising is projected to account for 28% of global streaming revenues by 2028, up from 20% in 2023.(8) In other words, this transformation is already happening.

An Olympic-Sized Turning Point

The 2024 Paris Olympics will be seen as a turning point for live sports advertising and streaming. The programmatic ad strategy pioneered by NBCUniversal will likely become the new standard for other major sporting events, offering more targeted, cost-effective advertising opportunities for a larger pool of media buyers. This shift not only democratizes access to premium sports advertising: it ultimately solidifies the role of digital platforms in shaping the future of media consumption.

1. EMARKETER; 2. Reuters; 3. Hollywood Reporter; 4. Marketing Dive; 5. S&P Global Market Intelligence; 6. Marketing Charts; 7. PwC.

Read the Article