Solomon Partners Financial Sponsors and Campbell Lutyens Full Interview Transcript

Solomon: Can you share an overview of Campbell Lutyens services including its secondary advisory capabilities?

Campbell Lutyens (“CL”): Established in 1988, Campbell Lutyens is the largest independent private markets advisory firm of its type globally with more than 290 employees across its offices in New York, London, Paris, Munich, Chicago, Los Angeles, Dubai, Charlotte, Hong Kong, Melbourne, Singapore, Tokyo, and Seoul. CL is 100% employee-owned by current employees, with no external shareholders.

CL is recognized as a market leader in private equity, real assets, and private credit globally across three business lines:

- Global fund placement: 30+-year track record with high completion rates; team has raised more than $315bn for 295+ private equity, real asset, and private credit funds

- Secondary advisory: 25+-year track record having completed $135bn+ of transaction volume across 330+ mandates to date

- GP capital advisory: Consult leading fund managers on a wide range of financings and transactions including minority and/or majority equity investments, M&A, alternative financing structures, secondary sales of GP minority investments, succession planning and valuation advice

Within secondary advisory, CL advises across a range of secondary solutions, including LP portfolios sales as well as continuation funds and other GP-led liquidity transactions. In 2024, the firm advised on $23bn of total secondary volume, including $11bn of GP-led transactions. CL has advised on continuation vehicles — ranging in size from $100m to $3bn+ — and is very active particularly across the middle market advising on such transactions.

What trends are you seeing across recent CV activity?

CV transaction volume is at a record high and continues to gain momentum. Total GP-led volume in H1 2025 was $48bn, up 72% year-over-year. This growth followed a record year of annual CV volume in 2024 of $65bn, up 47% from 2023 and eclipsing the previous high-water mark set in 2021 of $60bn. Sales to CVs accounted for a record 13% of total private equity exits globally in 2024, up from 5% in 2021, as CVs continue to take share from sponsor-to-sponsor transactions.

Several factors driving the sustained growth of the CV market include:

- Challenging traditional exit markets (M&A, IPOs) have led more sponsors to seek alternatives for their assets

- Many LPs remain overweight to PE and are looking to their GPs to generate liquidity

- New capital sources, including direct sponsors and family offices, have entered the secondary buy-side to invest in CV opportunities

- Ability for sponsors to utilize CVs as a strategic fundraising tool amid a challenging primary fundraising environment

Can you share the benefits of CVs for all stakeholders in a transaction?

The key stakeholders in a CV transaction include the GP, company management, existing LPs and new investors, with select benefits for each:

- GP:

- Secure longer runway to retain and grow winning asset(s)

- Raise follow-on capital to support strategic growth plans

- Create DPI for existing vehicle(s)

- Crystallize carried interest generated to date

- Achieve new remuneration structure and realign incentives

- Broaden LP relationships

- Management team (in addition to select items noted above):

- Ability to continue partnering with current sponsor owner

- Fully crystallize and cash out portion of MIP/equity stake

- Existing LPs:

- Option to generate liquidity and de-risk returns; or

- Maintain exposure and participate in the upside generated by the continuation fund

- New investors:

- Opportunity to complete deeper due diligence than in a traditional secondary transaction

- Ability to structure GP alignment, fund terms and governance to fit profile of the investment

What factors lead to a successful CV outcome?

Features of an attractive continuation vehicle asset typically include:

- Sufficient scale – for buyout-focused opportunities, companies with at least $20m of EBITDA, with the sweet spot being $30-50m+ for most mid-market focused investors

- Sector-resilient industries such as software, business services, healthcare, infrastructure, and industrials are in favor

- Market positioning – preference to invest in market-leading businesses with pricing power and ability to pass through cost inflation

- Strong historical performance – for single-asset CVs, companies that have delivered 2-3x+ MOIC to the existing fund(s)

- Conservative leverage – ideally no higher than 4-5x EBITDA

- Ownership/cap table – preference to invest in assets where the sponsor holds majority interest

- Accretive follow-on opportunities – ability to deploy capital to drive growth, in particular for buy and build strategies

- Strong upside potential – secondary investors will typically target a net MOIC of at least 2x+ over the next 3-5 years

Can you describe the components of a CV process – how is it similar/different to a sell-side process?

A CV process typically takes 4-5 months and combines elements of both an M&A sell-side and a traditional fundraise.

The initial part of the transaction is geared toward finding a lead or anchor investor that will set price/terms, negotiate definitive documentation and write a meaningful ticket into the CV. This is typically conducted through a two-stage auction process over a 7-8-week period. Diligence materials including a CIM and model alongside other company/market related materials (e.g., Q of E) are shared with potential anchor investors at the outset, with the GP also making themselves available for diligence calls during the initial phase. Following the receipt of initial indications (4 weeks), shortlisted investors are provided with an additional period (3-4 weeks) to conduct more detailed diligence, including holding potential management meetings/site visits. On the receipt of binding offers, a lead or group of lead investors is selected to negotiate key transaction documentation, including a PSA between the CV and the existing fund(s) and an LPA for the new vehicle.

Following the lead investor phase, a syndication process is conducted over the next several weeks to raise the equity commitments needed to cover the remainder of the transaction. Syndicate investors will review the materials prepared to date and heavily rely on the diligence conducted by the lead investor(s), with some groups still potentially wanting to spend direct time with the GP.

Once the transaction is fully subscribed, the existing fund’s LPAC is consulted to waive any related conflicts for the transaction, followed by an LP election process (typically 20 business days), where existing investors are asked to make a decision to either sell or roll their exposure into the CV.

How has the mix between single-asset and multi-asset CVs shifted, and what are the key drivers behind it?

In 2024, single-asset transactions represented nearly 60% of the CV market, driven by a larger supply of GPs looking to retain top assets and increasing appetite from investors to make concentrated bets in a rising market environment. So far in 2025, we have seen a more even split of volumes between single and multi-asset CVs (53% and 47%, respectively), as certain traditional secondary investors favor acquiring more diversified exposures and GPs show an increased willingness to include more assets and maximize DPI impact in a low-distribution environment.

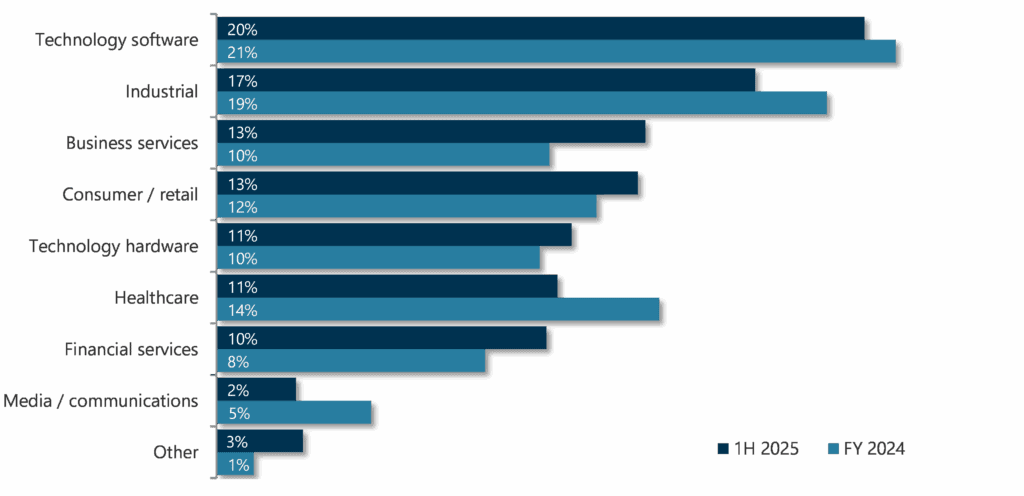

Are there specific sectors or asset types driving most of the GP-led activity?

Please see below a breakdown of assets sold in GP-led transactions by sector. In general, investors continue to favor insulated industries, including technology, business services, industrials, and healthcare.

Have there been any innovative structures in recent CV offerings?

We are seeing sponsors creatively incorporating continuation funds into broader strategic initiatives at portfolio companies. As an example, CL is currently advising on a process involving two mid-market sponsors that are contemplating a CV in tandem with a proposed merger of two underlying assets. Also, we are starting to see some sponsors who face primary fundraising challenges turning to broader fund restructuring secondary transactions as a means to raise capital for new platform investments.

What are your views on activity over the next 12-18 months, with the potential for Fed rate reductions and increased PE exits/IPO window re-opening?

We expect CV volumes to continue to grow over the near-to-medium term. While there are some early signs that the M&A and IPO markets may finally be easing/opening, there continues to be a growing NAV pool of assets within private markets which sponsors will need to deliver liquidity on. We expect continued adoption by GPs of CV technology and expect most sponsors going forward to pursue at least 1-2 CVs per fund. Most sponsors we speak with look at CVs as a strategic tool to continue to grow and compound their best assets and are pursuing these transactions for the right reasons vs. viewing CVs as just another exit option. Buy-side capital for these opportunities will further scale as direct sponsors continue to enter the space and established players raise larger flagship funds and/or dedicated GP-led vehicles.

Campbell Lutyens participants in this interview included:

Gerald Cooper

Partner & Global Co-Head of Secondaries

Chirag H. Shah

Managing Director

Stephen Henderson

Managing Director

Brian Susetka

Managing Director