Accessing free streaming content has never been easier. Smart TVs and streaming devices have evolved to fuel-rising demand for cost-effective cable alternatives. The combination of linear channels with robust on-demand libraries positions FAST for exceptional growth.

Tech-Supported Market Expansion

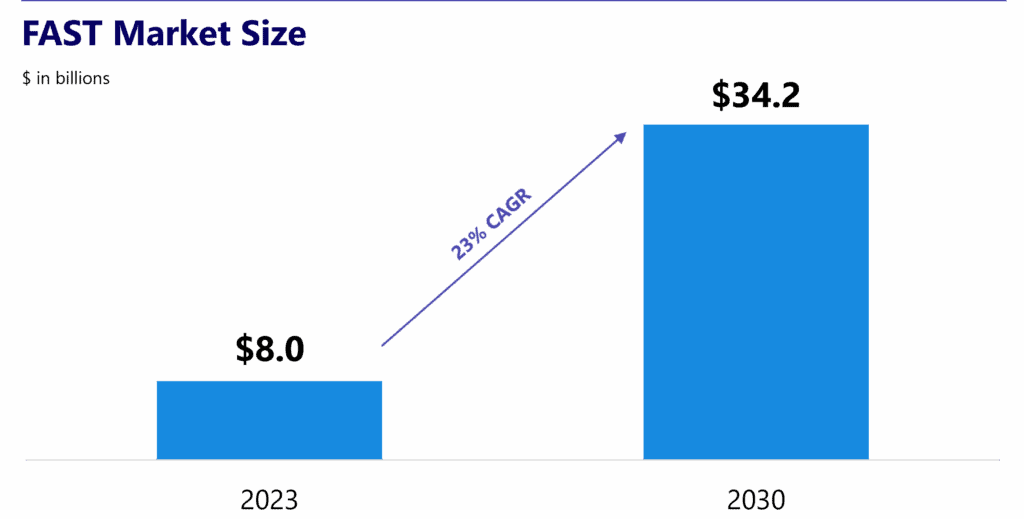

The global FAST market was estimated at $8.0 billion in 2023 and is projected to grow 23% per year through 2030(1). Internet access is more prevalent than ever, naturally guiding consumers to streaming options that are not tethered to a physical cable connection. FAST platforms combine the familiarity of linear TV with the flexibility of streaming, providing a range of free, ad-supported content without requiring a subscription. Many smart TVs now come with FAST services pre-installed, making access seamless. The ability to browse both live and on-demand content within a single platform adds a layer of convenience that is accelerating FAST adoption.

FAST Supercharges Ad Spend

FAST is emerging as a major catalyst for digital advertising growth, offering scale, targeting and measurable performance for brands. Digital’s share of total advertising spend has grown from 54.3% in 2019 to 72.7% in 2024, representing nearly $400B in incremental spend over five years(2). As subscription-based video on demand (SVOD) providers raise subscription prices, free ad-supported video on demand (AVOD) alternatives are gaining traction among budget-conscious consumers. Simultaneously, rising digital ad spend is pushing more streaming services to expand into FAST, and advertisers are eager to capitalize on AVOD’s unique advantages. Unskippable ads lead to more time in view, which has been proven to increase sales uplift(3). Viewers are also more willing to accept ad breaks in exchange for free content. Advancements in targeting enable advertisers to extract greater value from viewer data, driving both engagement and return on ad spend.

As the streaming landscape evolves, FAST stands at the intersection of consumer demand and advertiser efficiency — delivering scalable reach, data-driven outcomes and affordable access.

1. Grand View Research; 2. Statista; 3. Dentsu.