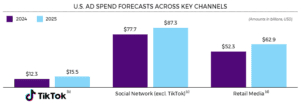

Case Study: Potential U.S. TikTok Ban

Ban could migrate $12B-$16B in advertising revenue to other ad channels

Potential U.S. TikTok Ban

On January 17, 2025, the U.S. Supreme Court unanimously upheld a federal law requiring China-based ByteDance to divest its ownership of TikTok by January 19, 2025, or face an effective ban of the platform in the U.S. This call for a divestiture stems from national security concerns over TikTok’s data collection practices and its ties to China.

After a short period of deactivation on January 19, 2025, TikTok was reactivated but remains delisted from the Apple and Google app stores. On January 20, 2025, President Trump signed an executive order to delay enforcement of the ban, allowing TikTok to remain operational for at least 75 days.

TikTok Ad Spend Migration

A U.S. TikTok ban could result in advertisers migrating their $12.3 billion in TikTok ad spend to other advertising channels. If migrated based on 2024 total media ad spend, Digital would capture the largest share with ~$9.7 billion, but other channels would also benefit, with out of home (OOH) capturing ~$290 million.ª

TikTok attracted advertisers with its broad reach of ~100 million U.S. users in 2024. In addition to other social media platforms, advertisers will seek to shift dollars to fast-growing channels, such as retail media, that can provide highly-tailored ads. For additional insights and more, visit our Media team.