Solomon Partners 2018 Energy Update

November 7, 2018

Energy markets continue to go through a significant transformation. Developments in technology, government policy and increasing demand and consumption have continued to shape the industry.

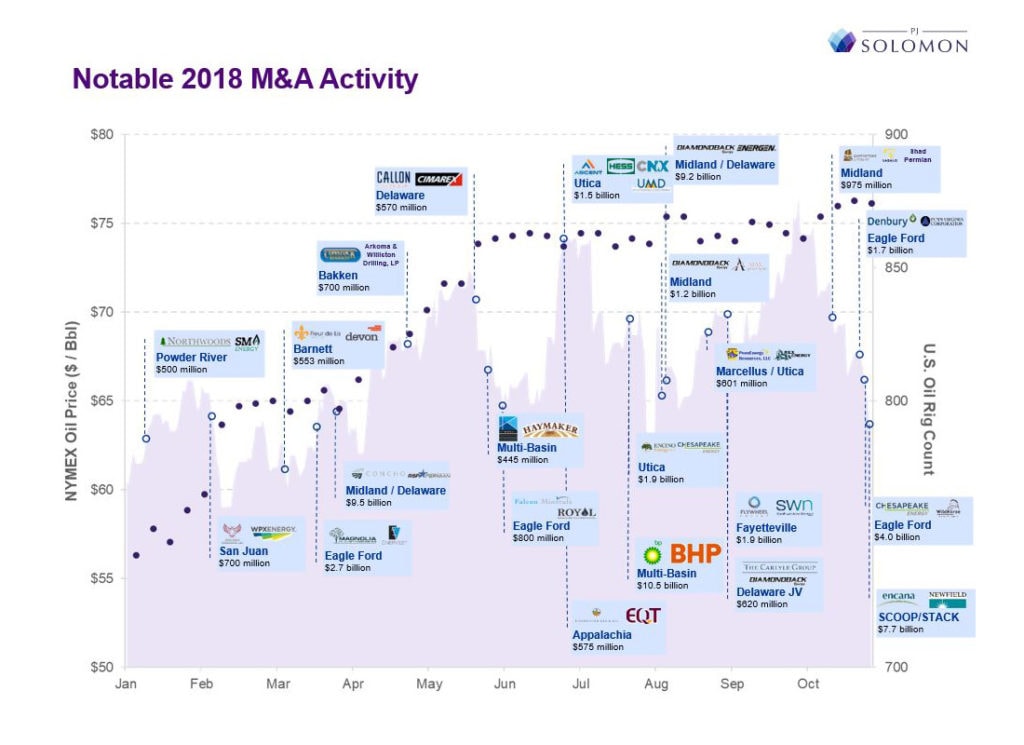

M&A has been driven by oil-weighted activity for the past two years, primarily the Permian Basin. This trend has continued in 2018, with the Eagle Ford and Powder River also having significant contributions.

Change is just beginning. Here are five key trends we’ve seen in 2018 that we expect to continue:

- A&D activity remains muted amid broader market and industry volatility, though M&A focus has sharpened

- After reaching four-year high, geopolitical (Iran, China and Saudi Arabia) and administrative (mid-term elections) uncertainty fueling recent oil price woes

- Sluggish equity price performance and constrained capital appetite impacting multiple basins

- Financial sponsors and management teams have seized market opportunity in the absence of strategic public buyers

- Lack of quality assets and limited universe of potential buyers have severely impacted valuations, aside from core areas in the Permian

The Solomon Partners Energy Group continues to evaluate this market and provide strategic advice to clients across the energy chain.