Why it matters:

- Retail media networks, where retailers sell ad space on their digital platforms, grew revenues by more than $10 billion in 2023, reaching $119.4 billion, and are expected to grow 8.3% in 2024, according to GroupM.

- Walmart Connect, for example, saw a 20% increase in revenues in last year’s third quarter.

- Instacart said that its ads provide an incremental sales lift of more than 15% for its brand partners.

The media platforms available to advertisers have grown exponentially over the past few decades from a handful of TV and radio channels, magazines, and newspapers to thousands of websites, podcasts, and other digital programming.

Retail media networks have emerged as a powerful player in this ecosystem, allowing advertisers to reach consumers who are actively shopping for purchases, both online and in-store. When combined with the trove of shopper data that retailers have, and technology that applies advanced analytics to this data, these platforms can deliver timely, personalized messages to customers, driving increased sales.

Retail media networks also drive incremental revenues for retailers, which charge advertisers for the access to shoppers that they provide. Retailers have long leveraged in-store flyers and other platforms to charge promotional fees to product suppliers, but the growth of digital connectivity and loyalty programs has fostered more sophisticated media networks that enable more targeted advertising strategies.

With retail media networks, retailers can effectively “surround the consumer in a 360-degree fashion,” both in-store and online, said Mark Boidman, Partner and Head of Global Media at Solomon Partners.

Retail media networks: ‘From an advertising perspective, they’re pretty effective’

Retail media networks grew revenues by more than $10 billion in 2023, reaching $119.4 billion, according to a recent report from GroupM. These networks are expected to grow revenues 8.3% in 2024, the report predicted.

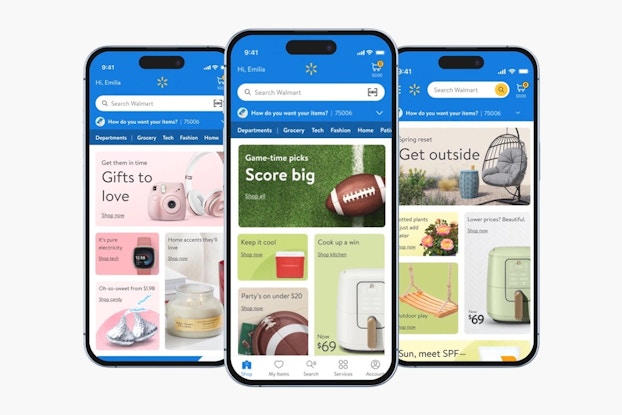

Ad spending is shifting away from some traditional forms of marketing and into retail media networks, Boidman said, citing the mass audiences of companies such as Walmart, Amazon, and Instacart. The Walmart Connect retail media network, for example, reaches more than 212 million people each month in the company’s stores, and another 125 million online, said Boidman.

“From an advertising perspective, it’s pretty effective,” he said.

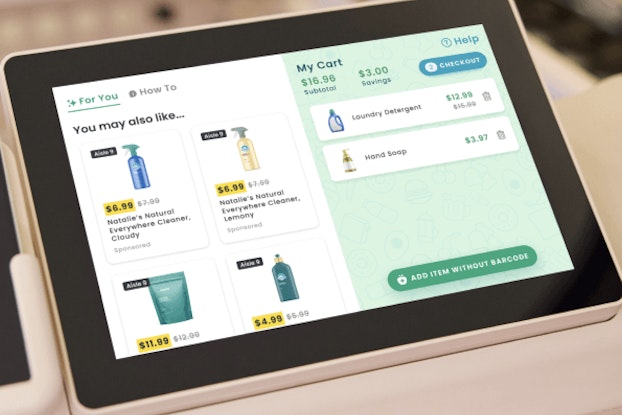

While the online component of retail media networks has been key for marketers reaching e-commerce shoppers, the in-store component has increasingly become recognized for its power in reaching consumers at the point of purchase. Retailers have installed a variety of in-store media, such as video screens in aisles, on shelves, and on endcaps, as well as audio and physical displays.

Walmart, for example, last year said it ramped up its in-store media presence, using approximately 170,000 digital screens, such as those on self-checkout machines, at its 4,700 stores. It also rolled out an in-store radio advertising platform that allows advertisers to target specific stores. In recent earnings calls, the company has cited Walmart Connect as a significant growth opportunity, with revenues up 26% in last year’s third quarter, for example.

Other retailers ramping up their in-store media platforms include Kroger, which in 2022 expanded the reach of its Kroger Precision Marketing media network to include video and closed-circuit TV options for advertisers. Then, last year, the retailer said it was adding “digital smart screens” in 500 stores across the U.S. through a partnership with Cooler Screens, which turns refrigerator doors into digital ad platforms.

The retailer recently described the network as a “higher-margin profit stream” for the company. Kroger has been focused on providing more self-service tools to its advertising partners, which is providing them more direct access to Kroger shoppers and enhanced measurement of ad performance, the company said.

[Read: Why Brands Are Investing in Digital Out-of-Home Advertising to Drive Business]

DICK’S Sporting Goods: In-store audio ads help advertisers ‘truly reach the DICK’S athlete wherever they shop’

DICK’s Sporting Goods is also among the retailers that have tapped in-store media platforms to expand their retail media network in their brick-and-mortar stores. The DICK’s Media Network recently began collaborating with Vibenomics to deliver audio ads in its stores.

“This new partnership allows us to extend the impact of retail media into the [brick-and-mortar] nexus and help advertisers truly reach the DICK’S athlete wherever they shop, participate in the growth of the retail media sector, and help to lead it into the future,” Benjamin Weisel, Director, Media Strategy & Sales, DICK’s Sporting Goods, said in an interview with CO—.

The new audio platform seeks to broadcast messages that enhance the shopper experience, without interrupting it, he said.

“Advertisers have a growing appetite to impact the [brick-and-mortar] part of the shopping journey, where big-box and specialty retailers continue seeing the lion’s share of transactions and are newly afforded more control in how their products and brands come to life through the eyes and ears of the athlete,” Weisel said. “The ability to serve messages at that critical point of consideration in-store is incredibly valuable.

Advertisers have a growing appetite to impact the [brick-and-mortar] part of the shopping journey, where big box and specialty retailers continue seeing the lion’s share of transactions … The ability to serve messages at that critical point of consideration in-store is incredibly valuable.

Benjamin Weisel, Director, Media Strategy & Sales, DICK’s Sporting Goods

“It’s even more powerful when used as a contributing piece of a larger, full-funnel strategy — an approach with which many of our strategic partners are beginning to see momentum,” he said.

Wiesel said he expected ongoing growth momentum in the retail media space, as DICK’s Media will continue to seek out new tools and strategic partnerships to enhance its reach and measurement capabilities.

[Read: Trend Forecasters on Four Key Consumer Trends Set to Impact Business in 2024]

Blending online and in-store data gives advertisers ‘robust insights into campaign effectiveness across channels’

The Vibenomics audio platform is made even more powerful by the company’s recently announced partnership with Microsoft’s Retail Media, formerly known as Promote IQ, said Paul Brenner, Senior Vice President of Retail Media and Partnerships at Vibenomics.

While Vibenomics brings expertise to the use of in-store audio and displays, Microsoft helps connect in-store and online interactions, enabling messaging that can span across multiple consumer touchpoints, Brenner explained.

“Together, we’re merging the digital and physical worlds to surround audiences while also giving advertisers unique insights and robust data into campaign effectiveness across channels,” said Brenner. “This powerful combination highlights the immense possibilities of unified online, offline, and in-store retail media strategies.”

Initial grocery store pilot programs leveraging the Vibenomics-Microsoft partnership have involved a synchronized delivery of audio ads in brick-and-mortar locations and digital ads on retailer websites. These test rollouts leverage geographic controls and enable precise measurement of the incremental impact from individual audio and online ads, and the amplified lift from their combined messaging, Brenner explained.

Early results are showing that a blended audio-digital approach can drive “significant lift” for brands and retailers, compared with using only one channel, he said.

Instacart deploys multi-pronged media network strategy for grocers of all sizes

Instacart, which provides a third-party grocery e-commerce shopping and delivery service, has one of the largest retail media networks in the grocery industry, operating under the Instacart Ads umbrella. In last year’s third quarter, the company’s first as a public company, Instacart reported that advertising and other revenue totaled $222 million, or more than a third of the company’s total revenues for the period.

Instacart has introduced several new ad formats and features during the past two years, including shoppable video and display ads, promotions, and impulse placements, as well as new measurement capabilities, the company said. Instacart said that its ads provide an incremental sales lift of more than 15% for its brand partners.

“As a younger advertising business in the industry, we learn from our brand partners every day,” said Tim Castelli, Vice President of Global Advertising Sales, Instacart. “By really listening to our partners’ needs, we’ve been able to build a strong business and product suite that helps drive incremental sales for their businesses.”

The ability to measure ad performance is a key element of the success of retail media networks, he said, and Instacart has been focused on demonstrating the impact Instacart Ads has on its partners’ objectives.

In addition to its own media network, Instacart also offers its Carrot Ads service to the brick-and-mortar retail partners for which it provides online shopping and delivery, enabling small- and mid-sized retailers to benefit from their own shopper databases. Last year, Sprouts Farmers Market began leveraging this offering to create its own retail media network, capitalizing on Instacart’s ad technology and sales capabilities.

“At Sprouts, we are committed to serving our health-enthusiast customers, and are excited to offer new ways to connect them with our innovative and distinctive brand partners," said Nick Konat, President and Chief Operating Officer, Sprouts Farmers Market, in a statement at the time. “By leveraging Instacart's ad technology, we are enabling this connection – and giving our brand partners even more ways to grow with us and our customers.”

In addition to its Carrot Ads service, Instacart also recently announced a partnership with The Trade Desk that seeks to help CPG advertisers enhance their programmatic campaigns using Instacart’s first-party data.

‘It’s really a generational thing’

In some ways, retail media networks are ideally suited for young consumers in particular, who expect a high degree of personalization and tend to obtain information via digital and video-based platforms rather than traditional TV or print media.

“It’s really a generational thing,” said Boidman. “Younger consumers say they discover new brands and products through ads or things that flash on screen during a TikTok video or walking around in a store. If they see an ad pop up on a screen, it’s a way for them to discover new products and brands.

“They don’t have television the way we did to discover brands, or learn about brands, or have brands reinforced,” he said.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.